Source: Business Today

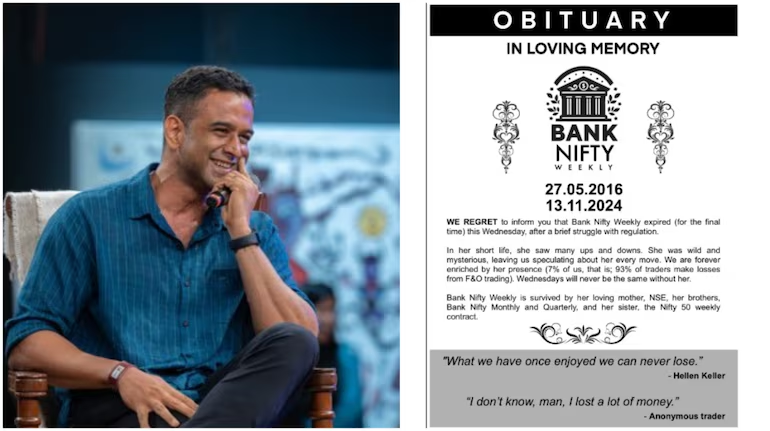

Zerodha co-founder Nithin Kamath’s recent farewell to Bank Nifty Weekly options has drawn significant attention from India’s financial community, with traders and analysts alike weighing in on the impact this change will have on the trading landscape. Kamath’s message humorously acknowledged the end of Bank Nifty Weekly expiries due to regulatory shifts that will now limit expiries to monthly options. While the shift marks the end of a high-activity era in options trading, Kamath’s humorous approach showcased Zerodha’s adaptability and his connection with the trading community.

The Rise of Bank Nifty Weekly Options

The National Stock Exchange (NSE) introduced Bank Nifty Weekly options in 2016, initially aimed at providing more frequent trading opportunities. These options quickly gained popularity among retail and institutional traders, offering them the ability to enter and exit positions more frequently and allowing greater flexibility in hedging strategies. By 2024, Bank Nifty Weekly options had captured almost a third of India’s index options volume, making them a key player in the nation’s rise as the world’s largest options market.

For Zerodha, Bank Nifty Weekly options have been central to driving futures and options trading volumes. The broker, known for its innovative approach, helped democratize trading for retail investors by lowering trading fees and simplifying the trading process. The popularity of Bank Nifty Weekly options also played a role in Zerodha’s growth, as the high-frequency trading they encouraged aligned with Zerodha’s active trader base.

Why the Shift to Monthly Options?

In late 2024, regulatory changes mandated a shift from weekly to monthly expiries for Bank Nifty options. This move was reportedly made to address concerns over market volatility, speculative trading, and potential risks associated with high-frequency options trading. Regulators believe that moving to monthly expiries will encourage more stable, long-term investments and reduce the risk of short-term speculation that often drives extreme market fluctuations. While this policy may curb some volatility, it could have implications for liquidity, hedging strategies, and trader engagement.

The Impact on Zerodha and Active Traders

Kamath acknowledged that this change would likely result in a 60% drop in Zerodha’s futures and options trading volumes. Bank Nifty Weekly options had been a staple for active traders who thrived on high-frequency trading opportunities. These traders often built strategies around the unique characteristics of weekly options, such as quick turnarounds, lower time decay, and the ability to capitalize on intraday volatility. With the elimination of weekly options, Zerodha’s user base may need to adapt to new trading strategies, focusing more on monthly options or exploring other instruments like stocks, ETFs, and long-term options.

For active traders who relied on weekly options, the shift could mean fewer trading opportunities and less flexibility in managing risk. The weekly options format allowed traders to make quick adjustments in response to market trends, while monthly options require more long-term planning and may not accommodate fast-paced strategies as efficiently. Many Zerodha users expressed mixed reactions on social media, with some disappointed by the loss of weekly opportunities and others optimistic about adapting to a less volatile trading environment.

Kamath’s Witty Farewell

Kamath’s humorous farewell message began with the words “We regret to inform you…” as though announcing the passing of a beloved tradition. The witty send-off not only acknowledged the end of an era but also underscored Zerodha’s rapport with its users, who have come to appreciate Kamath’s transparency and candor. This transparency has been a hallmark of Kamath’s approach to business, making Zerodha stand out in the highly competitive brokerage industry. By addressing the changes with humor and openness, Kamath reminded his audience that Zerodha remains dedicated to supporting its traders, even amid regulatory shifts.

Future Directions for Zerodha and the Indian Options Market

The elimination of weekly options also opens up new possibilities for Zerodha to diversify its offerings. Zerodha has long focused on democratizing trading and making investing accessible to the masses. With the limitations on high-frequency options trading, Zerodha may shift its focus to educational resources, encouraging users to adopt long-term investment strategies and explore other investment avenues. Additionally, the broker could enhance its platform features to support long-term portfolio management, catering to traders who may now have to adjust their trading styles.

The broader Indian options market will also have to adapt to this regulatory change. While the elimination of weekly options may reduce some of the speculative trading activity, it could encourage more institutional investors and long-term retail investors to participate. Monthly options could bring more stability to the market, fostering a less speculative environment that aligns with India’s growing reputation as a financial hub. Furthermore, this shift may encourage other forms of financial instruments to gain traction, such as bonds, mutual funds, and ETFs, as traders look for alternatives to active options trading.

A New Era for Indian Traders

While the end of Bank Nifty Weekly options may be disappointing for many active traders, it also signifies a shift towards a more stable and sustainable trading environment. Kamath’s candid and humorous farewell highlights Zerodha’s adaptability and commitment to guiding its users through changing market landscapes. As Zerodha and other brokerages work to adjust their strategies and offerings, the Indian trading community will have to embrace new methods and strategies to thrive in the evolving options market. This transition could ultimately lead to a more balanced trading ecosystem, benefiting both retail and institutional investors in the long run.

Kamath’s send-off was more than just a humorous remark; it was a reassurance to Zerodha’s traders that even in times of change, the company will continue to be a steadfast partner, offering insights, education, and support. As the trading landscape shifts, Zerodha’s approach to engaging with its user base may serve as a model for brokerages navigating regulatory changes while maintaining strong customer relationships.

Follow for more updates.