Source: Economic Times

In recent times, the Indian stock market has seen some notable pullbacks, with much of the discussion focusing on the role of institutional investors. Traditionally, Foreign Institutional Investors (FIIs) are perceived as the major influencers of market volatility due to their large capital inflows and outflows. However, a new perspective brought forward by Anurag Singh suggests that Domestic Institutional Investors (DIIs) are now playing a more pivotal role in driving the market pullback.

Understanding DIIs and FIIs

Before diving into the specifics of DIIs’ impact, it’s essential to understand the difference between DIIs and FIIs. FIIs are foreign entities that invest in the Indian stock market, often moving large sums of money in and out, making them sensitive to global events. DIIs, on the other hand, are Indian-based institutional investors, which include mutual funds, pension funds, and insurance companies. While FIIs provide short-term liquidity, DIIs have been known to bring long-term stability.

Historically, FIIs have held significant sway over Indian markets, especially in the early 2000s when they were major drivers of growth. However, recent data shows a shift in the dynamics. FIIs have been net sellers in recent years, pulling back from Indian equities due to global economic uncertainties. Conversely, DIIs, fueled by the rise of retail investments through Systematic Investment Plans (SIPs), have stepped in to absorb these sell-offs, becoming the primary buyers of Indian equities.

DIIs as the Drivers of Pullbacks

Anurag Singh’s argument that DIIs are now the real culprits of market pullbacks stems from their increasing influence. Over the last few years, DIIs have accumulated more equity, surpassing FIIs in terms of net investment in Indian markets. This shift has been driven by the rise of financial savings in India, with a growing number of investors opting for mutual funds and insurance products.

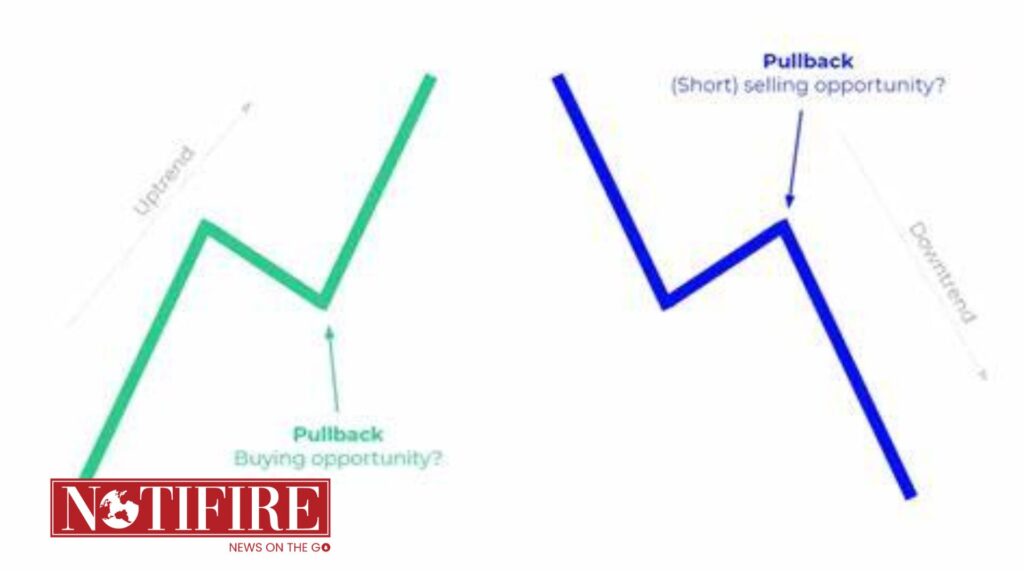

However, the role of DIIs in stabilizing the market has also introduced new risks. DIIs often act with a herd mentality, pulling money out during times of uncertainty to protect investor interests. When markets hit record highs, DIIs may decide to book profits, triggering broader sell-offs and contributing to pullbacks. This reactionary behavior contrasts with FIIs, who tend to take a longer-term approach and may continue to hold equities despite short-term fluctuations.

Impact on Retail Investors

Retail investors, who form the backbone of DIIs through SIPs and mutual funds, are particularly vulnerable to these pullbacks. While DIIs’ profit booking might be in the best interest of institutional portfolios, it can create volatility, causing retail investors to face losses or reduced returns. The growing dominance of DIIs in the Indian stock market has made them critical players, but also more prone to reactive movements, especially during peaks.

Why This Matters

The Indian stock market’s evolution from being heavily influenced by FIIs to DIIs signifies a maturing financial ecosystem. With DIIs playing a larger role, the market is becoming less dependent on foreign capital, but the increasing influence of domestic institutions also means that their collective actions can have profound impacts on stability. As DIIs continue to gain influence, their decisions, especially during times of market highs, will be closely scrutinized.

While FIIs may still be perceived as fair-weather investors, often blamed for pulling out during global downturns, DIIs’ behavior suggests that they, too, can contribute to corrections. As Anurag Singh points out, DIIs should not be overlooked when assessing the causes of pullbacks. Their growing influence over the Indian stock market means that their decisions have more weight than ever before, and their tendency to take profits during highs can exacerbate volatility.

As DIIs continue to grow in prominence, their role in pullbacks will likely be a topic of increasing debate. While they bring long-term stability to the Indian market, their actions during peak phases can trigger corrections that affect both institutional and retail investors. Understanding the behavior of DIIs and their increasing influence is crucial for anyone looking to navigate the complexities of the Indian stock market. For retail investors, staying informed about the movements of both FIIs and DIIs is essential for making sound investment decisions in an increasingly volatile environment.

Follow for more updates.