Source: The Economic Times

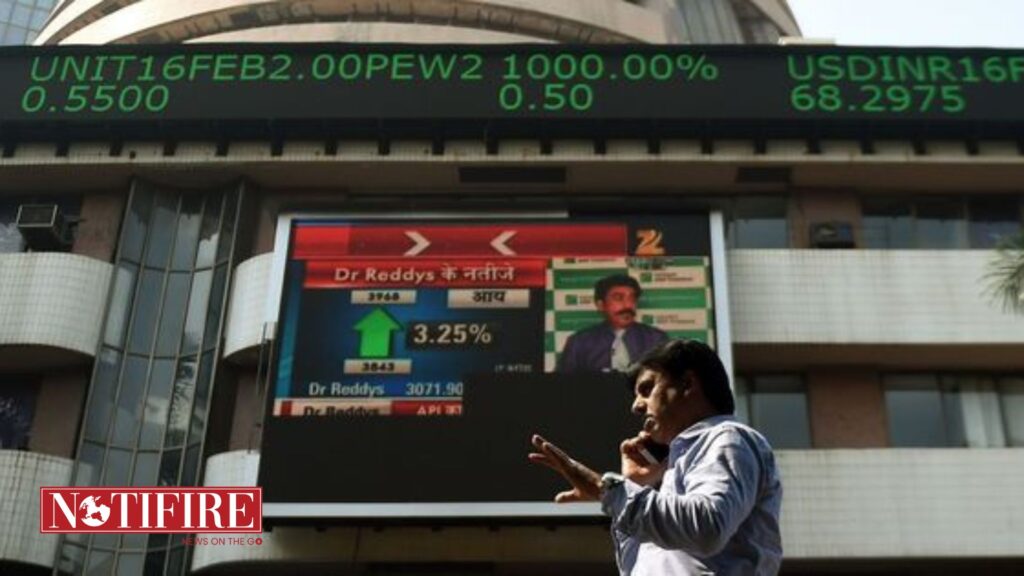

The Indian stock market has been on a rollercoaster ride, with recent sell-offs causing concern among investors. Several factors contribute to this downturn, including global economic uncertainties, inflation concerns, rising interest rates, and geopolitical tensions. Gurmeet Chadha, a renowned financial expert and market analyst, has shed light on the key reasons behind the ongoing sell-off in the Indian markets and what investors can expect in the coming months.

1. Global Economic Uncertainties

One of the major factors driving the sell-off in Indian markets is the prevailing global economic uncertainty. With inflation surging across developed economies like the US and the Eurozone, central banks have had to adopt aggressive measures, including rate hikes, to combat price rises. The US Federal Reserve has raised interest rates multiple times in 2024, triggering a ripple effect across global financial markets. As liquidity tightens, foreign institutional investors (FIIs) have been withdrawing capital from emerging markets, including India.

Gurmeet Chadha emphasizes that the global economic environment is in a delicate balance. With major economies flirting with recession and central banks walking a fine line between controlling inflation and fostering growth, market volatility is expected to remain high. For Indian markets, this has translated into large-scale sell-offs as foreign investors seek safer havens in developed markets.

2. Rising Inflation and Interest Rates in India

Inflation has been a persistent issue in India as well, with consumer prices rising due to higher fuel costs, supply chain disruptions, and increasing input costs for various sectors. The Reserve Bank of India (RBI) has been forced to follow the global trend of raising interest rates to curb inflation. However, these rate hikes have made borrowing more expensive, which in turn affects corporate profitability and consumer spending.

Gurmeet Chadha points out that while the RBI’s rate hikes were necessary to control inflation, they have also made it challenging for businesses to expand and for consumers to spend. This has led to reduced earnings expectations for several sectors, particularly those reliant on consumer demand, such as automobiles, real estate, and FMCG (fast-moving consumer goods). The combination of rising costs and reduced demand has added fuel to the sell-off.

3. Weakness in Corporate Earnings

A major reason for the bearish sentiment in the Indian market has been the weakness in corporate earnings across several sectors. Companies, especially in industries like technology, banking, and manufacturing, have reported lower-than-expected profits due to rising input costs, currency depreciation, and weaker global demand. This has led to downward revisions in earnings forecasts, prompting investors to reassess the valuations of Indian stocks.

Chadha highlights that technology and banking stocks, which were the darlings of the market in the previous bull run, are now facing headwinds. The technology sector has been hit hard by a slowdown in global IT spending, while banks are dealing with rising non-performing assets (NPAs) as businesses and individuals struggle to repay loans in a high-interest-rate environment.

4. Geopolitical Tensions

Geopolitical tensions have also contributed to the sell-off in Indian markets. The ongoing conflict between Israel and Hamas, along with persistent tensions between Russia and Ukraine, has created uncertainty in global markets. These conflicts have led to volatility in energy prices, particularly crude oil, which is a significant import for India. Rising oil prices put pressure on the Indian economy by increasing the current account deficit and fueling domestic inflation.

Chadha suggests that unless these geopolitical tensions are resolved, the markets are likely to remain jittery. Investors are concerned about the long-term impact of these conflicts on global supply chains, energy prices, and trade relations.

5. Foreign Institutional Investor (FII) Outflows

Another critical factor fueling the sell-off is the withdrawal of foreign institutional investors from Indian equities. FIIs have been net sellers in the Indian markets for several months, pulling out billions of dollars as they seek safer investments in developed markets. The strengthening of the US dollar and rising US Treasury yields have made it more attractive for foreign investors to move their money out of emerging markets like India.

According to Chadha, FII outflows are a direct result of the global shift towards risk-off sentiment. While India remains a promising long-term investment destination, in the short term, foreign investors are likely to continue pulling out their funds as they deal with uncertainty in global markets.

6. What Lies Ahead?

Looking ahead, Gurmeet Chadha believes that the Indian market will continue to face challenges in the near term. Global economic uncertainties, high inflation, rising interest rates, and geopolitical tensions will keep markets volatile. However, he remains optimistic about India’s long-term growth prospects.

Chadha advises investors to remain cautious but not panic. He suggests that long-term investors should look for opportunities in sectors that are likely to benefit from structural trends, such as renewable energy, technology, and pharmaceuticals. Additionally, he emphasizes the importance of maintaining a diversified portfolio to weather the ongoing volatility.

The recent sell-off can be attributed to a combination of global and domestic factors. Gurmeet Chadha’s insights highlight that while the short-term outlook remains challenging, India’s long-term growth story remains intact. Investors are encouraged to stay the course, focus on quality stocks, and take a disciplined approach to investing during these uncertain times.

In the end, market volatility is a natural part of the economic cycle, and savvy investors can use downturns as opportunities to build wealth for the future.

Follow for more updates.