Source: Money Control

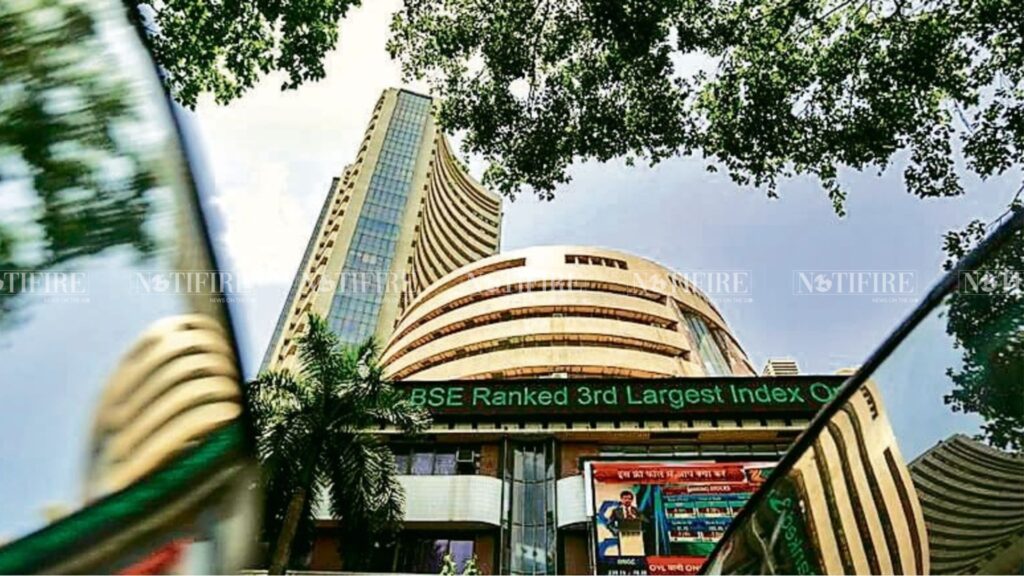

The Indian stock market has recently experienced a significant pullback following the “Trump Rally,” a surge that was fueled by optimism surrounding the U.S. election results in 2016 and expectations of favorable policies. After the initial surge, both the Nifty and Sensex indices have witnessed corrections, raising questions about the key factors contributing to this market decline. In this blog post, we explore the reasons behind the recent pullback in the Indian stock market and the broader economic and global factors at play.

The Impact of the Trump Rally

The “Trump Rally,” as it came to be known, began in the aftermath of Donald Trump’s surprising victory in the 2016 U.S. Presidential Election. The rally was driven by hopes of pro-business policies, tax reforms, deregulation, and infrastructure spending, which were expected to boost corporate earnings in the U.S. and globally. These expectations led to a wave of optimism in the stock markets, and Indian indices, such as Nifty and Sensex, were no exception. As a result, India saw a substantial inflow of foreign capital and strong upward movement in stock prices.

However, markets tend to experience cycles, and after an extended period of growth, corrections are a natural part of the market dynamics. The pullback in the Indian markets reflects a return to a more balanced valuation, driven by a combination of domestic and global factors. Let’s examine the key reasons behind the recent decline.

1. Global Economic Slowdown

A key factor behind the recent pullback in Indian markets is the slowing global economy. Several global economies, including the U.S. and China, have shown signs of decelerating growth. The U.S. Federal Reserve’s policy actions, particularly interest rate hikes, have increased borrowing costs, which can have a ripple effect on global liquidity and investor sentiment.

China, as one of India’s major trading partners, has also faced its own set of challenges. The ongoing trade tensions between the U.S. and China, coupled with China’s efforts to shift toward a more sustainable, consumption-driven growth model, have caused some concerns about the global economic outlook. A weaker global economy can lead to reduced demand for exports, lower corporate earnings, and a decline in investor confidence, all of which weigh heavily on the performance of emerging markets like India.

2. Rising Crude Oil Prices

Crude oil is a crucial input for the Indian economy, and fluctuations in its prices have a significant impact on both inflation and the current account deficit (CAD). Over the past few months, global crude oil prices have risen sharply, driven by production cuts from OPEC countries and geopolitical tensions in key oil-producing regions.

As oil prices rise, India faces higher import bills, which can lead to a deterioration in the current account balance and put pressure on the Indian rupee. A weaker rupee makes imports more expensive, further exacerbating inflation. In turn, rising inflation could prompt the Reserve Bank of India (RBI) to raise interest rates, which can negatively affect market sentiment and corporate profitability.

3. Inflationary Pressures and Interest Rate Hikes

Inflationary pressures have been building in India, driven by rising commodity prices, supply chain disruptions, and higher food prices. While the Reserve Bank of India (RBI) has been vigilant in keeping inflation within its target range, persistent inflationary pressures could force the central bank to take more aggressive action in raising interest rates.

Higher interest rates can lead to higher borrowing costs for businesses and consumers, which may reduce demand and overall economic growth. This has a direct impact on corporate profits, particularly in sectors like real estate, consumer goods, and automobiles. Consequently, the market may react negatively to potential rate hikes, contributing to the pullback in stock prices.

4. Geopolitical Risks and Global Uncertainty

Another factor contributing to the pullback in the Indian stock market is the rising geopolitical uncertainty. While India’s stock market had enjoyed optimism due to global risk-on sentiment, concerns about the global political landscape are starting to weigh on investor sentiment.

Tensions between major powers, such as the U.S.-China trade war, rising protectionism, and the war in Ukraine, are creating a global environment of uncertainty. For emerging markets like India, such geopolitical risks can result in capital outflows as investors seek safer assets in developed markets. These capital outflows can put downward pressure on stock prices, particularly in high-growth sectors.

5. Corporate Earnings Concerns

Another key reason behind the market correction is the disappointing corporate earnings reported by some major companies. While India’s economy continues to grow, some sectors have been struggling due to a variety of reasons, including high input costs, labor shortages, and lower-than-expected demand.

The quarterly earnings season often provides insight into the underlying health of the economy, and if corporate profits miss expectations or show signs of stagnation, it can lead to sell-offs. As corporate earnings slow down, valuations of Indian stocks may no longer seem as attractive, especially after a period of strong growth. This has led to some profit-taking and a pullback in the Nifty and Sensex.

6. Domestic Market Valuations

The Indian stock market had been on a bull run for several years, pushing stock valuations to high levels. While India’s growth story remains strong, valuations were starting to look stretched in some sectors. The pullback could be a natural consequence of overvalued markets correcting to more reasonable levels.

Investors tend to be cautious when stock prices exceed their earnings potential. As market corrections occur, prices often return to more balanced valuations, especially when corporate earnings growth is not matching the lofty expectations built into stock prices.

7. Foreign Institutional Investor (FII) Outflows

One of the key drivers of India’s stock market rally was the influx of foreign institutional investments (FII), which supported market growth by bringing in fresh capital. However, in recent months, there has been a shift, with foreign investors pulling back from emerging markets like India due to global economic concerns, higher U.S. interest rates, and risk aversion.

FII outflows from India have put pressure on the stock market, and as global investors recalibrate their portfolios in response to changing economic conditions, the Indian market has witnessed a pullback.

While the Trump Rally initially created a surge of optimism across global markets, including the Indian stock market, the recent pullback in indices like the Nifty and Sensex reflects the challenges of the current economic environment. Key contributing factors to this market correction include a slowing global economy, rising crude oil prices, inflationary pressures, and ongoing geopolitical uncertainties.

Corporate earnings concerns, especially the slower-than-expected growth projections for Indian companies, have been a significant factor weighing on investor sentiment. As the Nifty faces pressure from high valuations and slower earnings growth, foreign institutional investor (FII) outflows have added fuel to the fire. The market correction also reflects investor wariness about global and domestic economic factors, particularly amidst tightening financial conditions and political uncertainties.

Despite these short-term fluctuations, India’s long-term economic growth story remains intact. The Nifty, which represents a broad spectrum of India’s top companies, continues to hold strong growth potential. As global uncertainty looms, it is crucial for investors to focus on the long-term fundamentals of the Indian economy. This can help them navigate through market volatility and identify potential opportunities for growth. While short-term volatility is expected, the Indian stock market could rebound once these temporary factors are addressed, particularly as inflation and geopolitical tensions stabilize.

Follow for more updates.